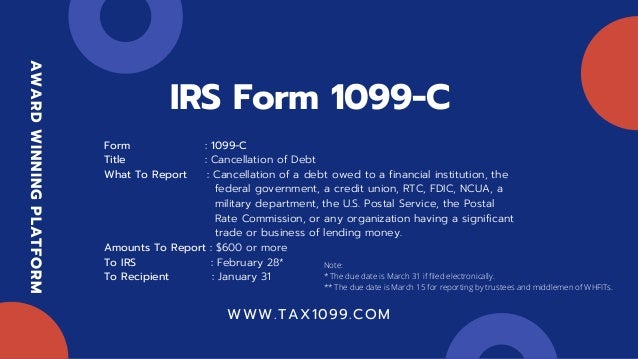

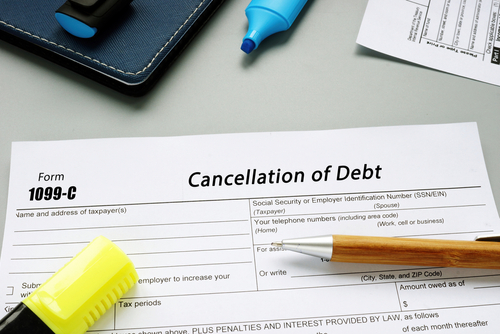

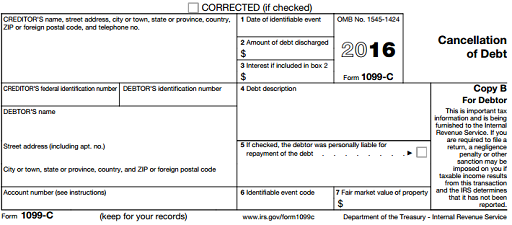

19 1099 C Form – A 1099 Form is really a form of doc that can help you determine the earnings that you simply attained from numerous sources It is crucial to be aware that there are many various kinds of taxpayers who may be needed to finish aForm Pros offers online generators for legal, tax, business & personal forms 132 W 36th Street, New York NYCancellation of Debt Form 1099C, Form 9;

Solved I Need To Know About The Insolvency Exception For 1099 C Do I Qualify How Do I Claim Insolvency

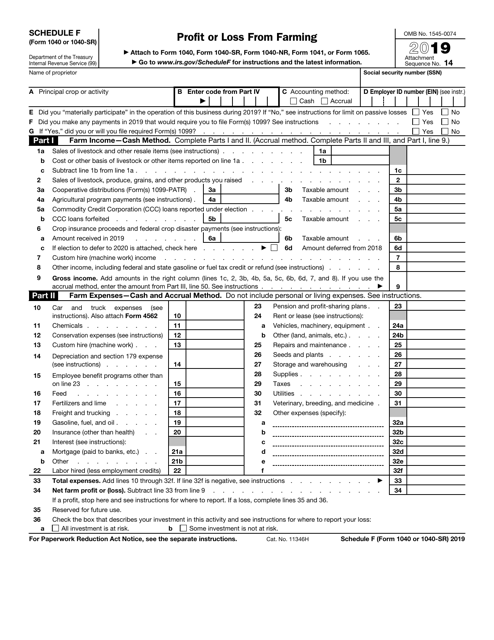

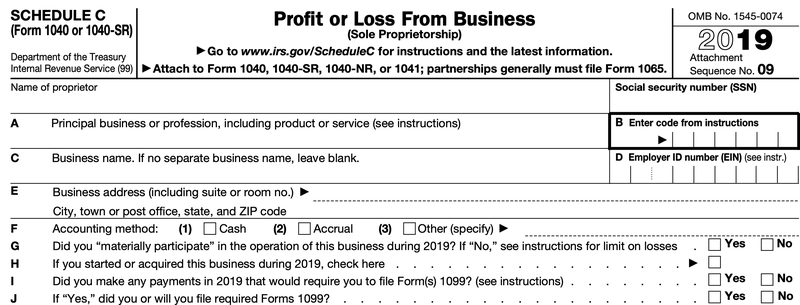

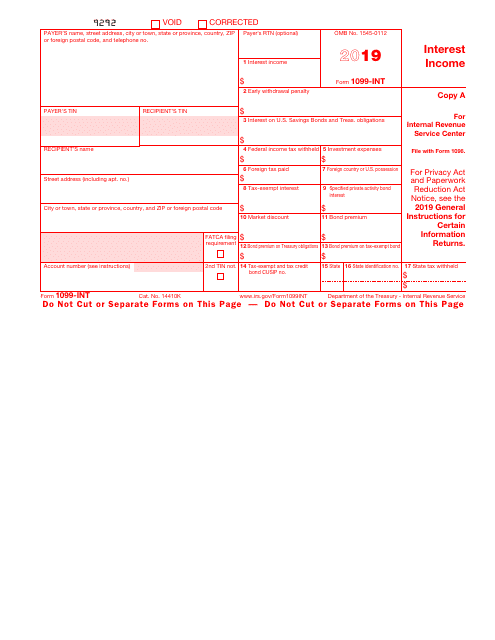

1099 schedule c form 2019

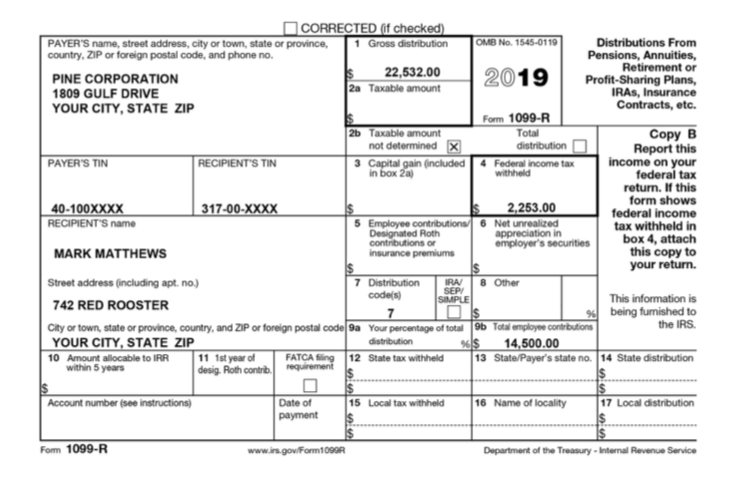

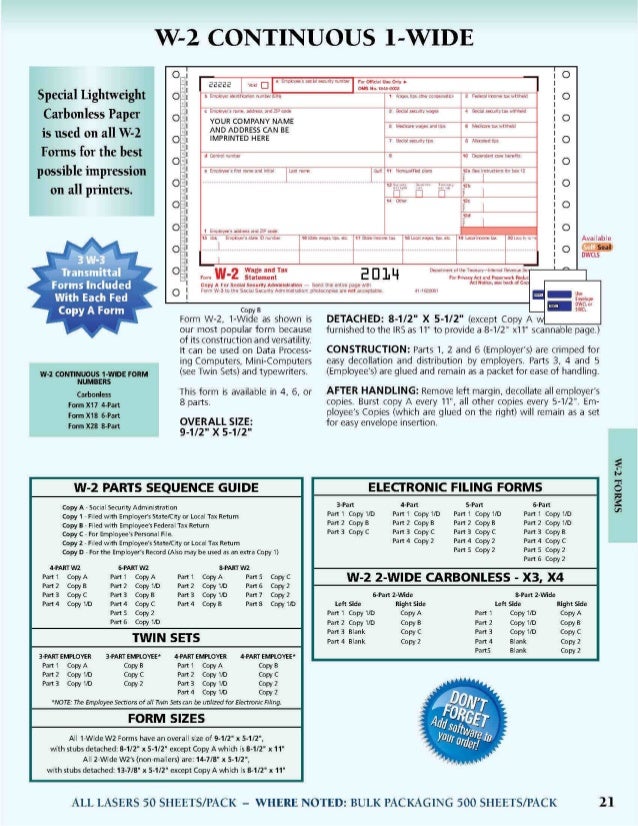

1099 schedule c form 2019-C Form 1099 Fill out, securely sign, print or email your 1099c 10 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start aThe due date for filing Forms 1099‑R, 1099‑MISC, and W‑2G for tax year 19 is The due date for filing Form 1099‑K is no later than 30 days after filing with the IRS Forms 1099R, 1099MISC, 1099K, and W2G Electronic Filing Requirements for Tax Year 19 State of Connecticut Department of Revenue Services IP 19(12)

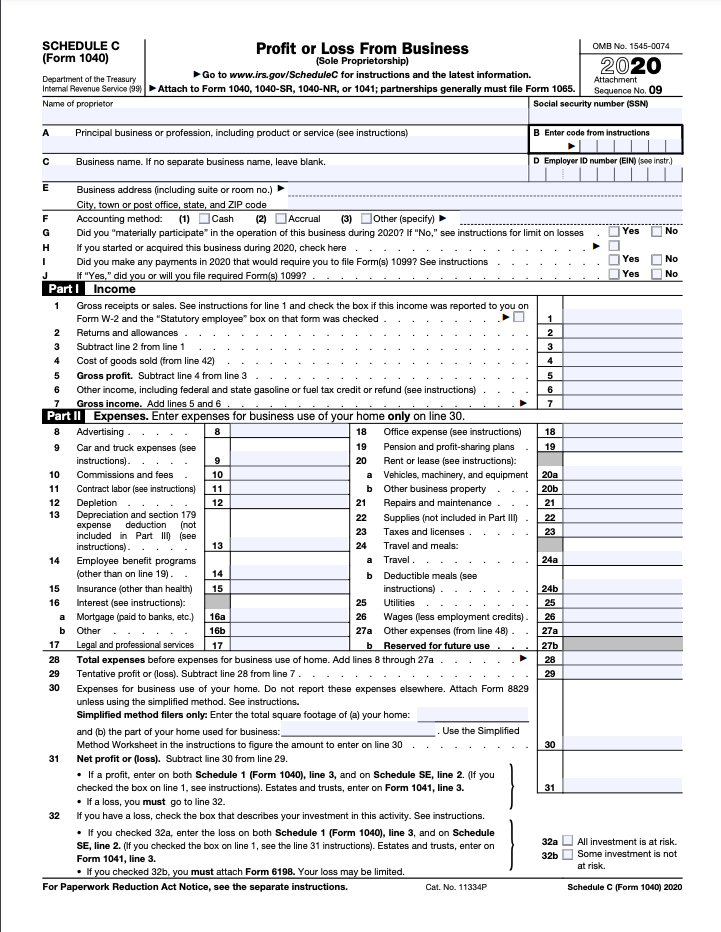

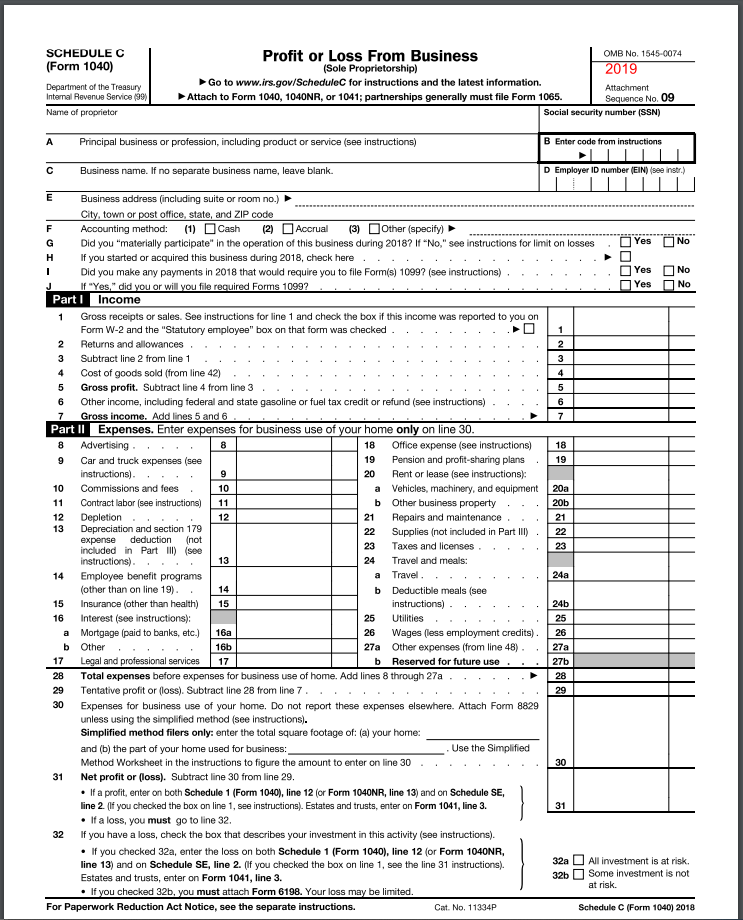

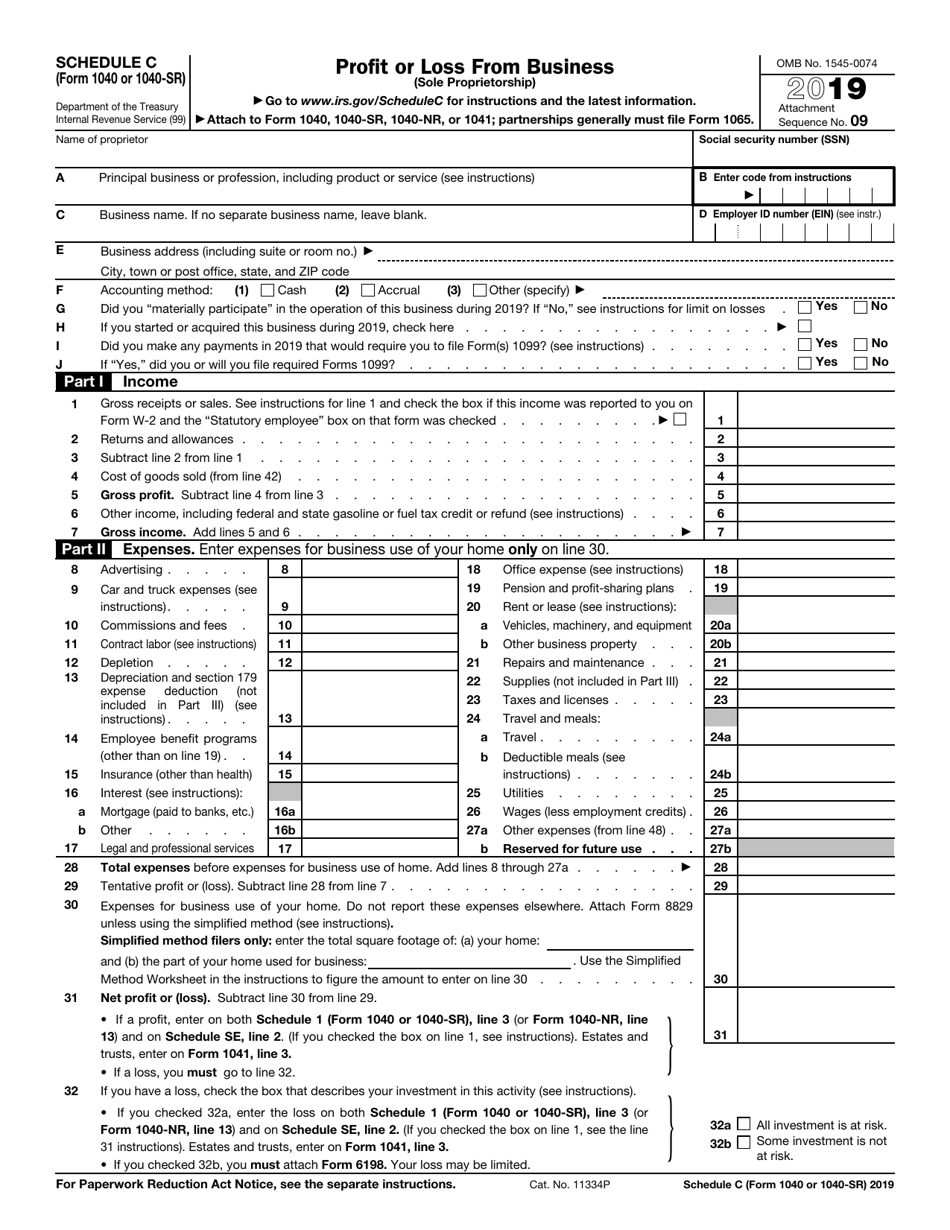

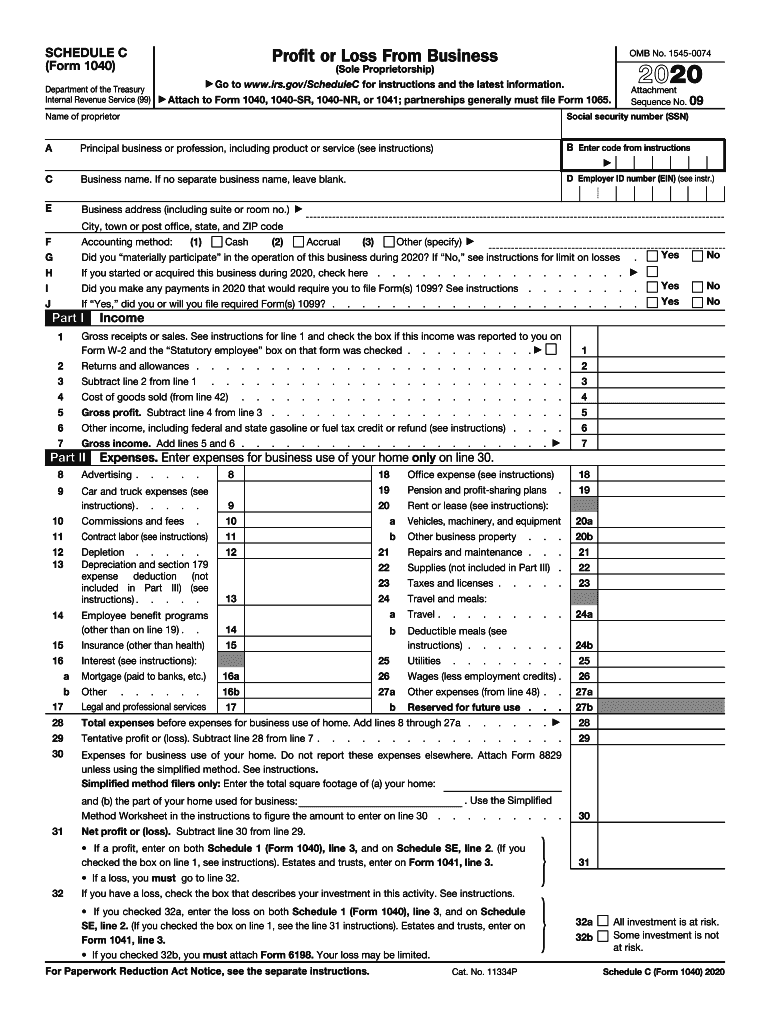

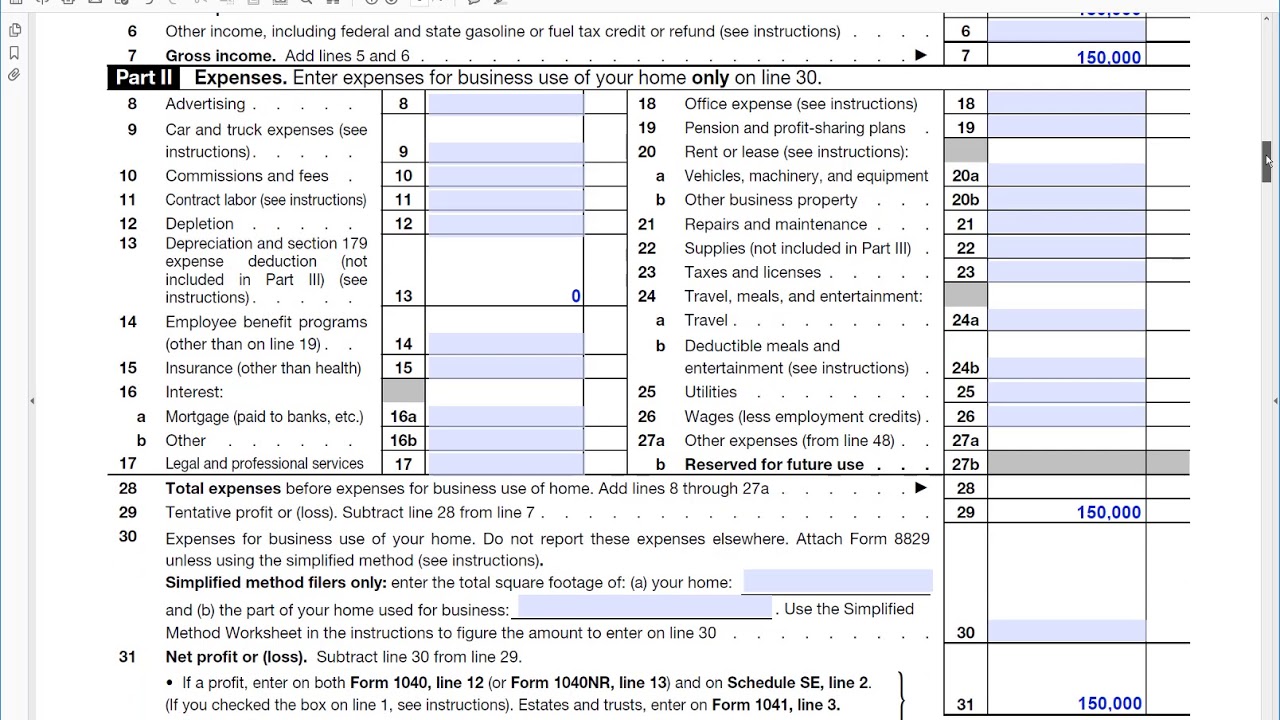

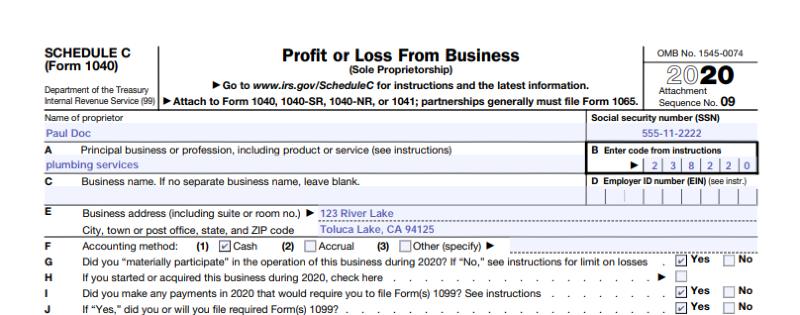

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

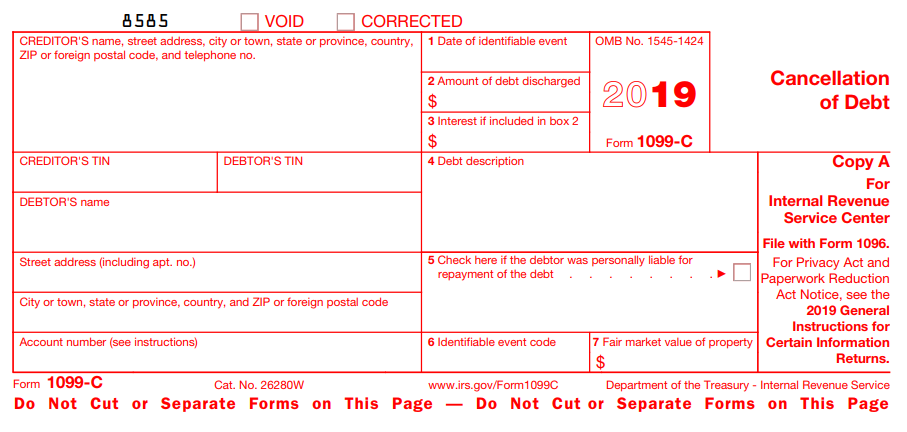

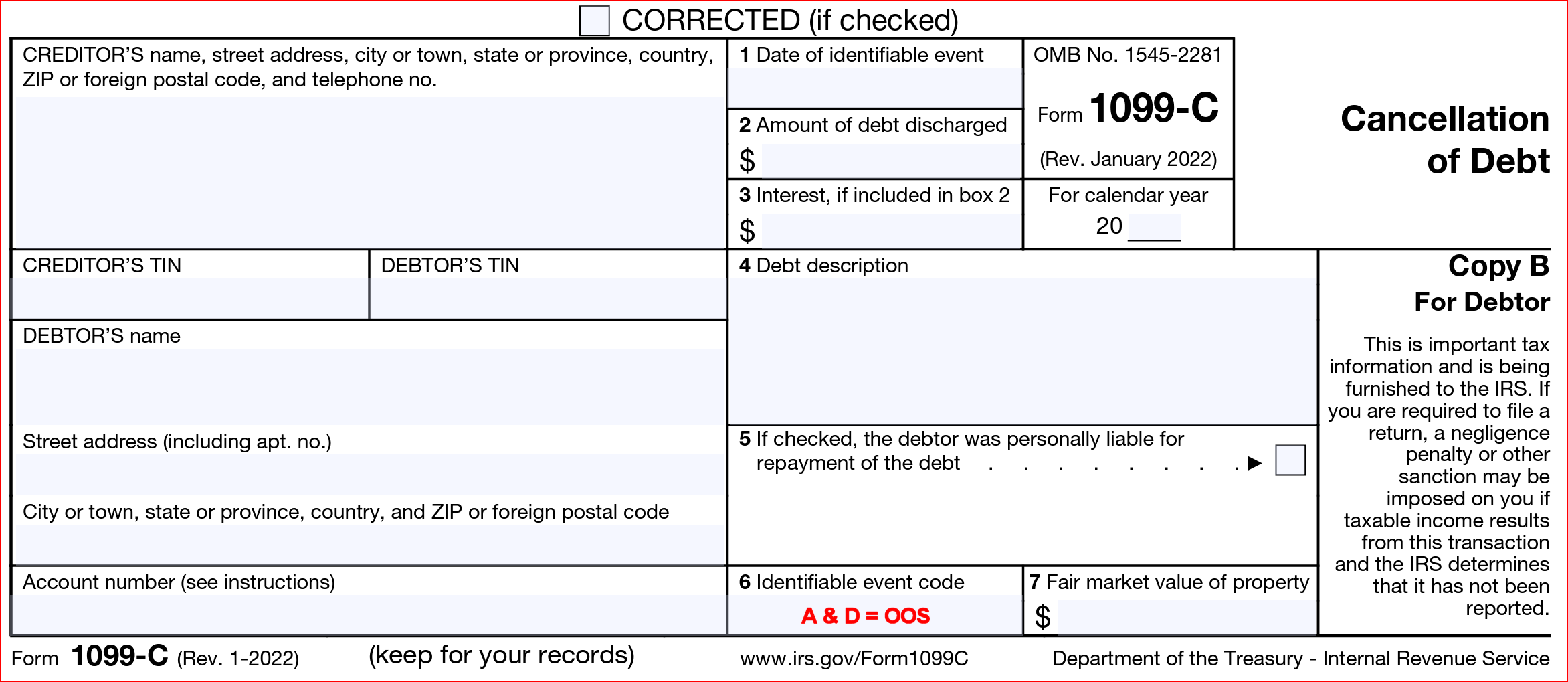

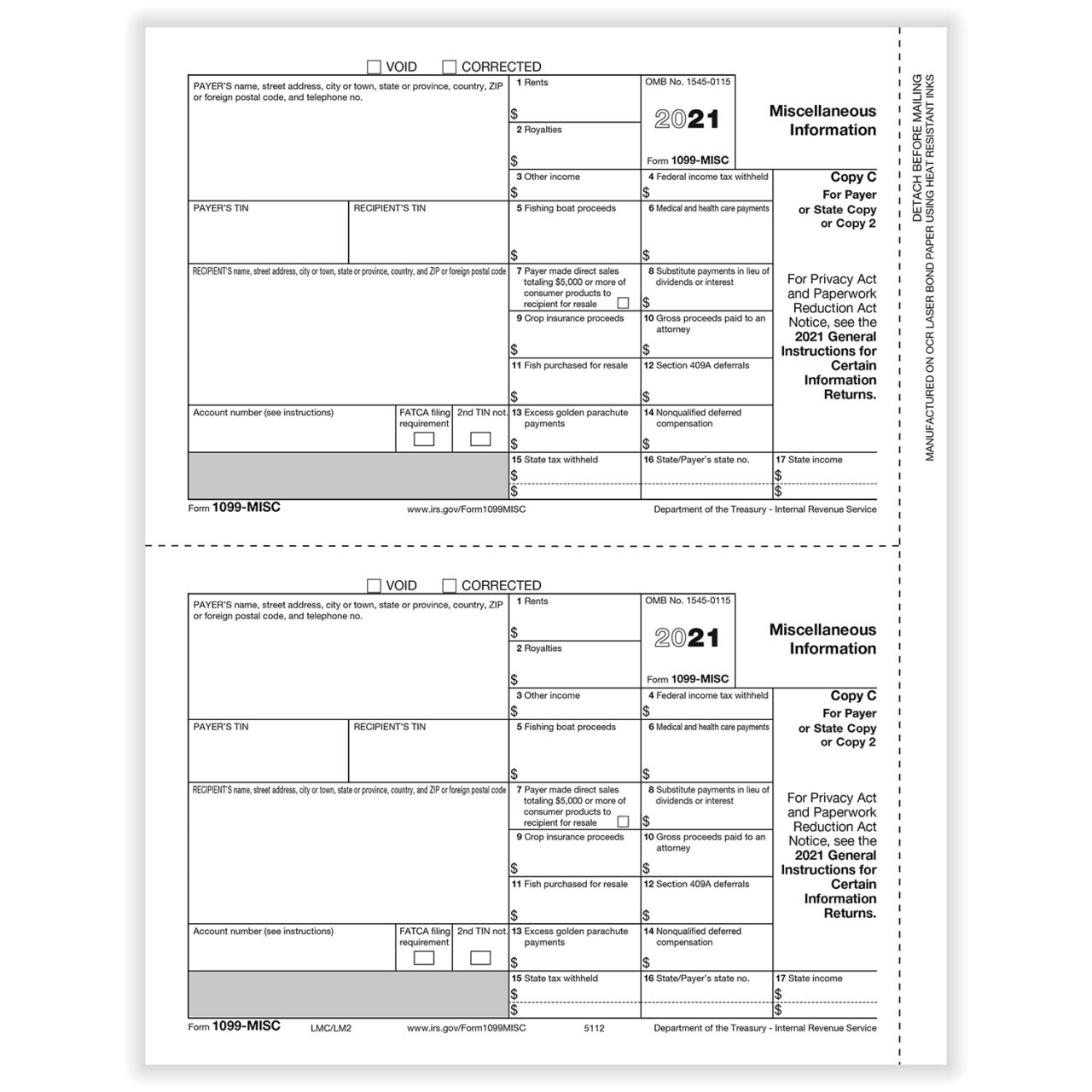

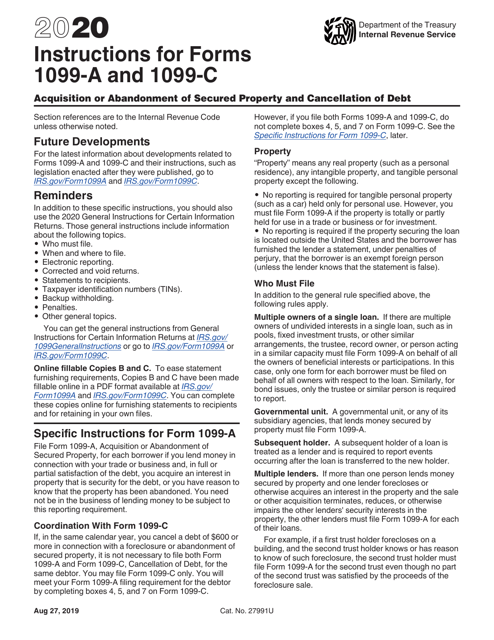

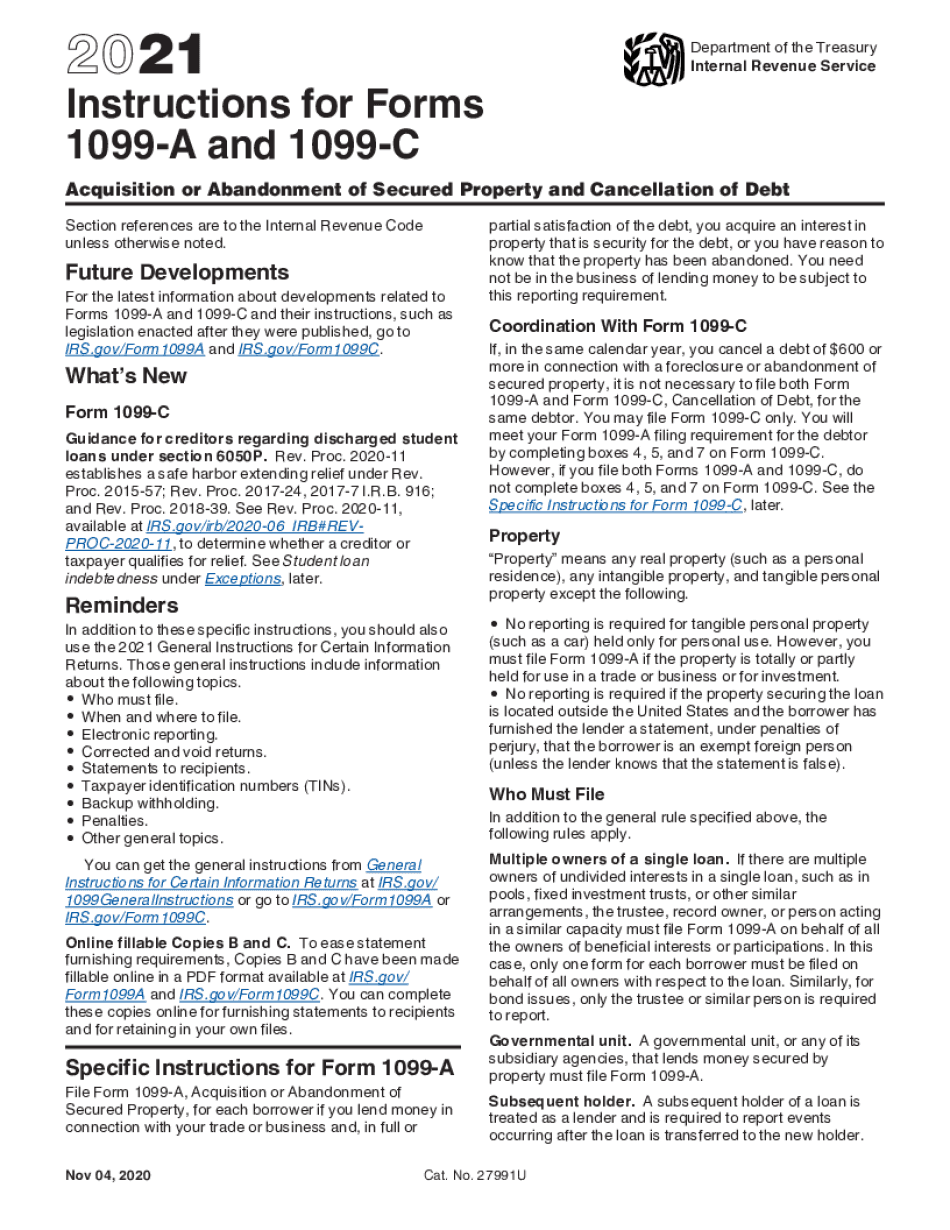

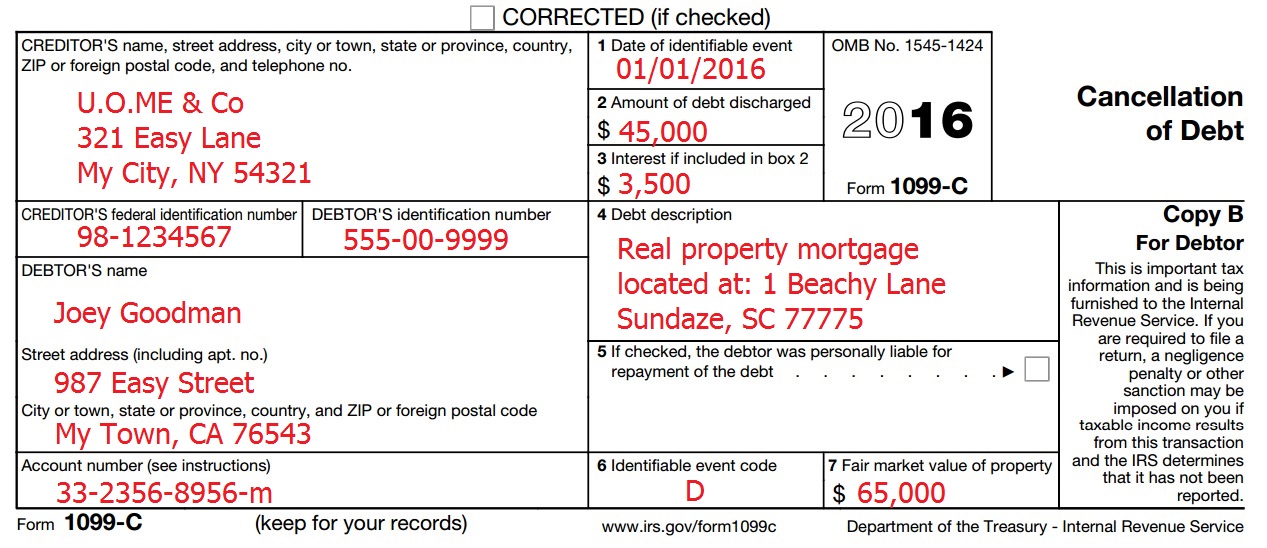

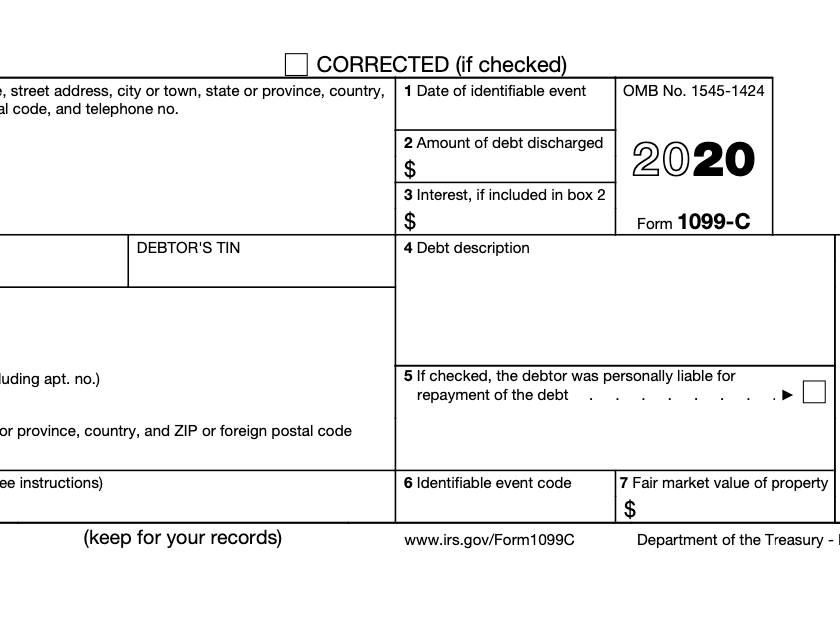

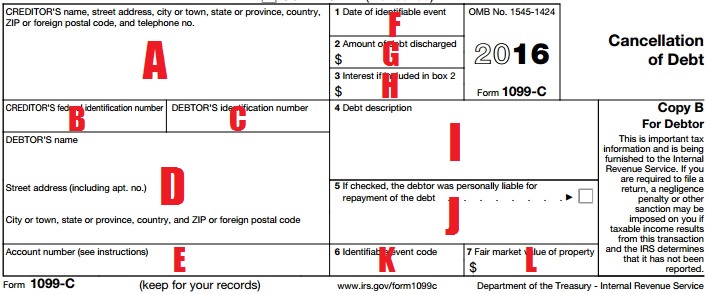

Form 1099C 19 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRSOnline technologies make it easier to arrange your file administration and boost the productivity of the workflow Look through the brief manual so that you can complete Form Instruction 1099A & 1099C, stay away from errors and furnish it in a timely way How to fill out a instructions 1099 19? IRS Publication 1 A document published by the Internal Revenue Service that identifies a taxpayer's rights and outlines the processes followed by the IRS when it examines a taxpayer, issues a

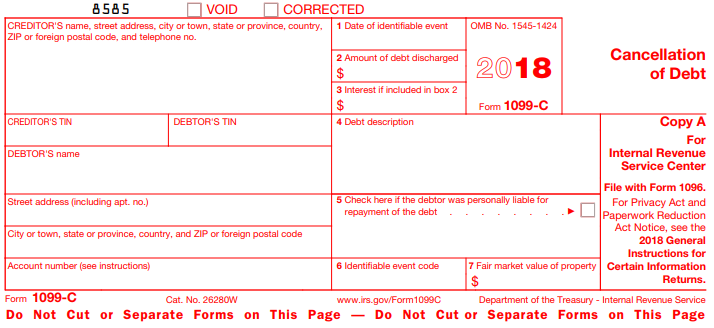

What is a 1099C?Schedule C Fillable Form 19 Fill out, securely sign, print or email your 19 Instructions for Forms 1099A and 1099C IRSgov instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!File Form 1099C for each debtor for whom a debt owed is $600 or more if the debtor is an individual, corporation, partnership, trust, estate, association, or company Form 1099C must be filed regardless of whether the debtor is required to report the debt as income

A form 1099C falls under the 1099 tax form series of information returns These forms let the IRS know when you have received income outside of your W2 income Any company that pays an individual $600 or more in a year is required to send the recipient a 1099 You are likely to receive a 1099C when $600 or more of your debt is dischargedFill Online, Printable, Fillable, Blank F1099c Accessible 19 Form 1099C Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable F1099c Accessible 19 Form 1099C On average this form takes 11 minutes to completeCoordination With Form 1099C If, in the same calendar year, you cancel a debt of $600 or more in connection with a foreclosure or abandonment of secured property, it is not necessary to file both Form 1099A and Form 1099C, Cancellation of Debt, for the same debtor You may file Form 1099C only You will

I Just Got A 1099 C Form For A Debt From 16 Years Ago

When To Use Tax Form 1099 C For Cancellation Of Debt Zipbooks

What to know about Form 1099C and cancellation of debt If you've received at least $600 in forgiveness for your student loans, you'll be sent a Form 1099C by your creditor The student loan forgiveness form will include the following information The lender;When a house is foreclosed upon by the bank or lender, the owners will typically receive Form 1099A from the lender showing several pieces of relevant information If you receive only Form 1099A, the information will be used to report the foreclosure as the sale ofIf you received both a Form 1099A Acquisition or Abandonment of Secured Property and a Form 1099C Cancellation of Debt for a rental property, enter the Form 1099C first to determine if the canceled debt is taxable If it is, you must decide whether or not to file Form 9 Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 10 Basis Adjustment) to exclude the

Irs 1099 C Form Pdffiller

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

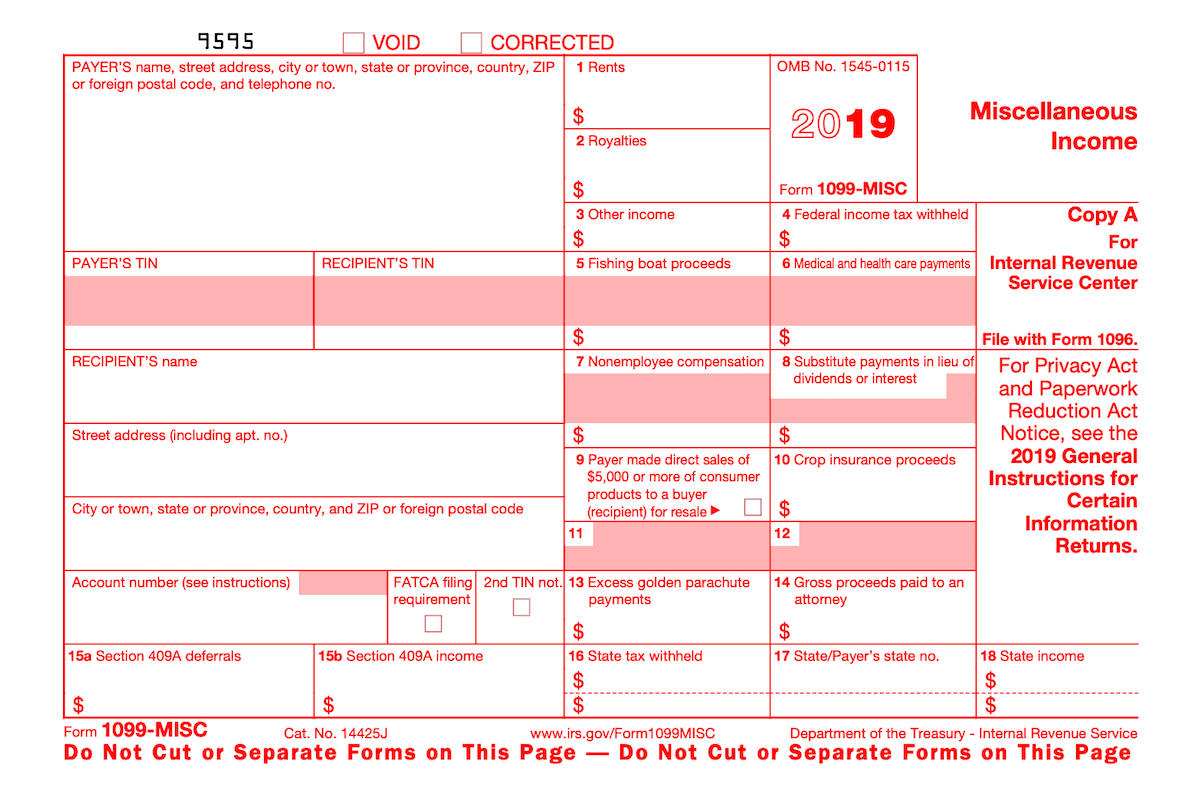

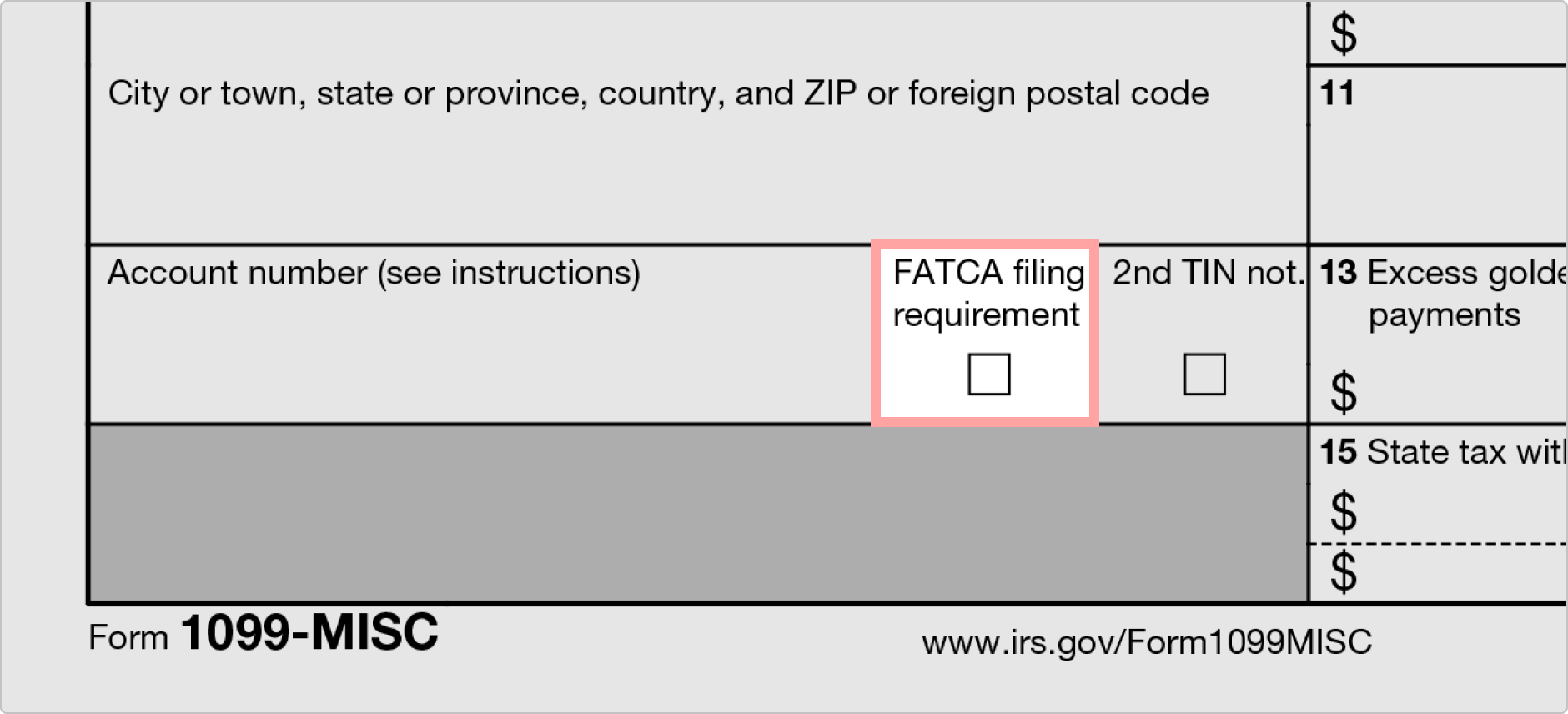

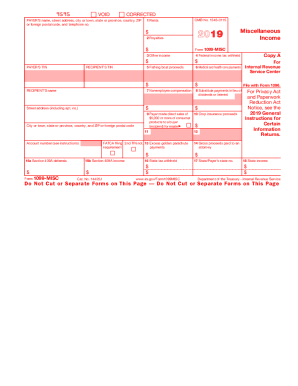

Form 1099C According to the IRS, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you You'll receive a Form 1099C, "Cancellation of Debt," from the lender that forgave the debt Common examples of when you might receive a Form 1099C include repossession, foreclosure, return of property to a lenderThe 1099MISC form is a form that reports an individual's extra earnings, aside from the salary paid by their employer The employer must generate a 1099MISC form and send it to his employee by January 31st, so that the employee can use it when filling his yearly taxes to the IRS (Internal Revenue Service) The 1099C form is specifically used to report income related to cancellation of debt The IRS considers forgiven debt as income because you received a benefit without paying for it If you borrowed $10,000 and only paid back $4,000, for example, then at some point you ended up with an "income" of $6,000

Form 1099 Cap Changes In Corporate Control And Capital Structure Definition

E File Form 1099 With Your 21 Online Tax Return

Use this stepbystep guide to fill out the Get And Sign Instructions Form 1099 C 1019 quickly and with ideal accuracy How you can fill out the Get And Sign Instructions Form 1099 C 1019 on the web To get started on the form, use the Fill & Sign Online button or tick the preview image of the documentUse this IRS form to report cancellation of a debt owed to a financial institution, the Federal Government, a credit union, RTC, FDIC, NCUA, a military department, the US Postal Service, the Postal Rate Commission, or any organization having a significant trade or business of lending moneyYou can print form 1099C and EFile form 1099C The IRS requires a 1099C form for certain acts of debt forgiveness because it considers that forgiven debt as a form of income Call now for a FREE consultation CALL For example, if you borrowed $12,000 for a personal loan and only paid back $6,000, you still received the original $12,000 If that unpaid debt was forgiven or

How To File Schedule C Form 1040 Bench Accounting

1099 C 18 Public Documents 1099 Pro Wiki

Printable 1099 form 19 are widely available All 1099 forms are available on the IRS website, and they can be printed out from home This is true for both 19 and 18 1099s, even years laterHowever, it is important to remember that each 1099 filing needs several copies of the form, and not all of them can be printed from home on regular computer paper Information about Form 1099C, Cancellation of Debt (Info Copy Only), including recent updates, related forms, and instructions on how to file File 1099C for canceled debt of $600 or more, if you are an applicable financial entity and an identifiable event has occurredOnce completed you can sign your fillable form or send for signing All forms are printable and downloadable form 1099misc miscellaneous income 19 pdf On average this form takes 37 minutes to complete The form 1099misc miscellaneous income 19 pdf form is 7 pages long and contains 0 signatures checkboxes

1

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

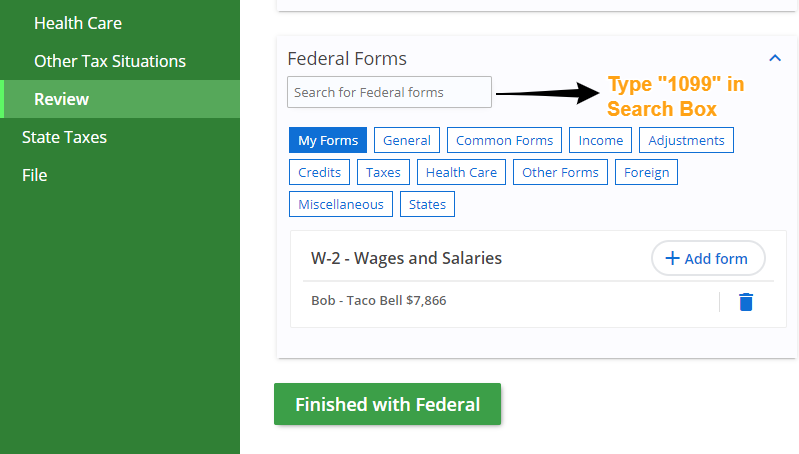

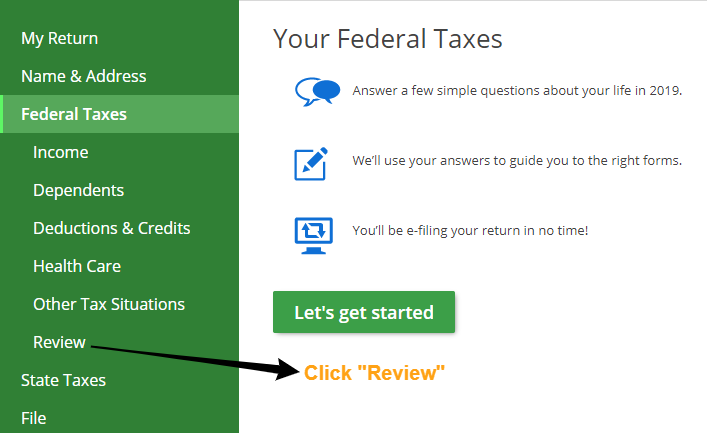

Fill Online, Printable, Fillable, Blank form 1099miscc miscellaneous income 19 Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable If your debt is canceled or forgiven, you'll receive Form 1099C (Cancelation of Debt) Note If you received a 1099C for your main home and another 1099C for something else (like a credit card, car loan, or second mortgage) you won't be able to use TurboTax, as we don't support this To enter your 1099C Open or continue your return, if it isn't already openGet 📝 1099 Tax Form for 19 years 📝 Instructions, requirements, print tax form and more for every 1099 form type MISC, Employe, C Dept and all other

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

Your Ultimate Guide To 1099s

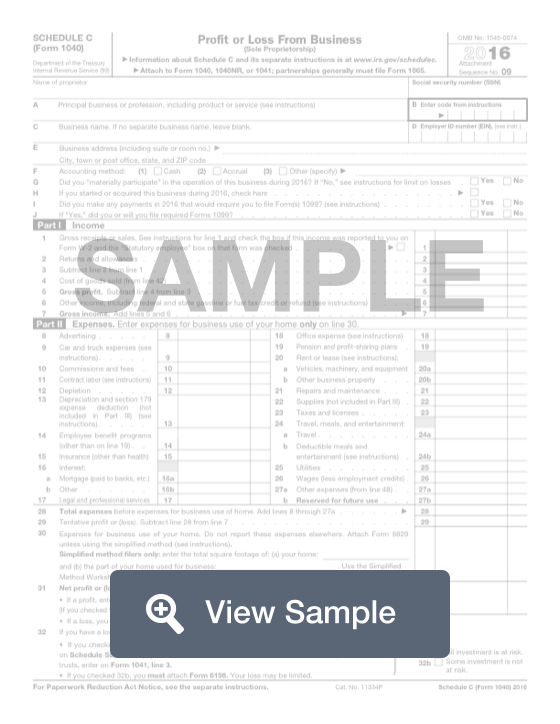

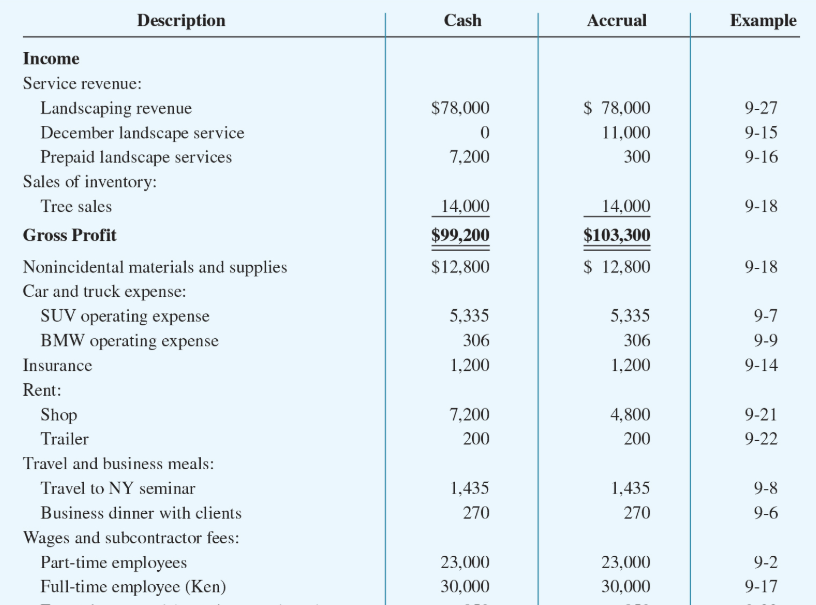

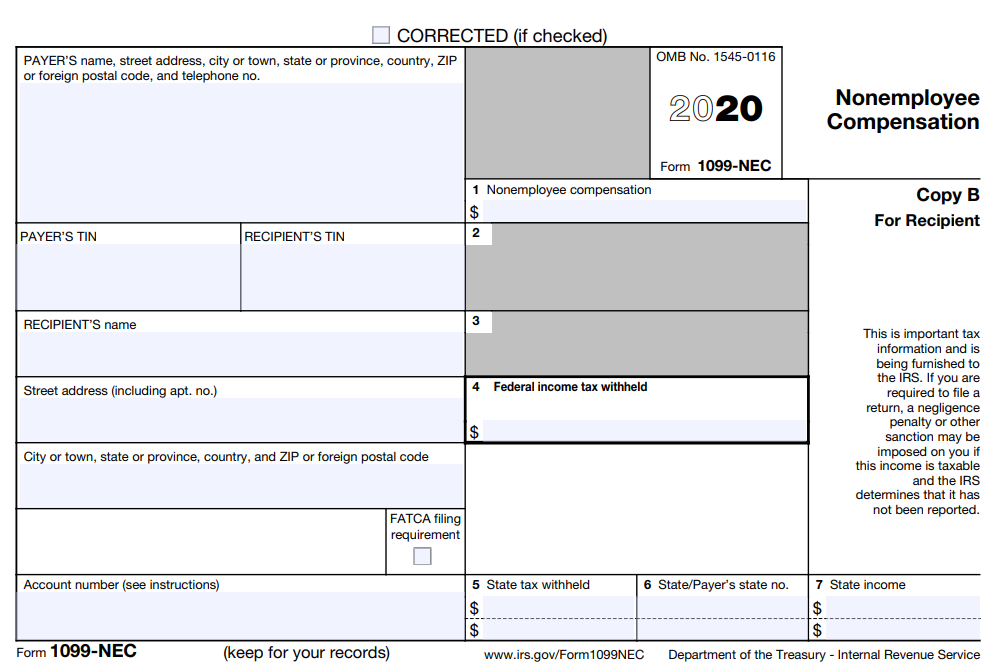

Form 1041, line 3 • If you checked 32b, you must attach Form 6198 Your loss may be limited } 32a All investment is at risk 32b Some investment is not at risk For Paperwork Reduction Act Notice, see the separate instructions Cat No P Schedule C (Form 1040 or 1040SR) 19Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099A and 1099C Acquisition or Abandonment of Secured Property and Cancellation ofFor individuals, report on Schedule C (Form 1040) Box 7 Shows nonemployee compensation If you are in the trade or business of catching fish, box 7 may show cash you received for the sale of fish If the amount in this box is SE income, report it on Schedule C or F (Form 1040), and complete Schedule SE (Form 1040)

What Is A 1099 Form Who S It For Debt Org

Irs Schedule C 1040 Form Pdffiller

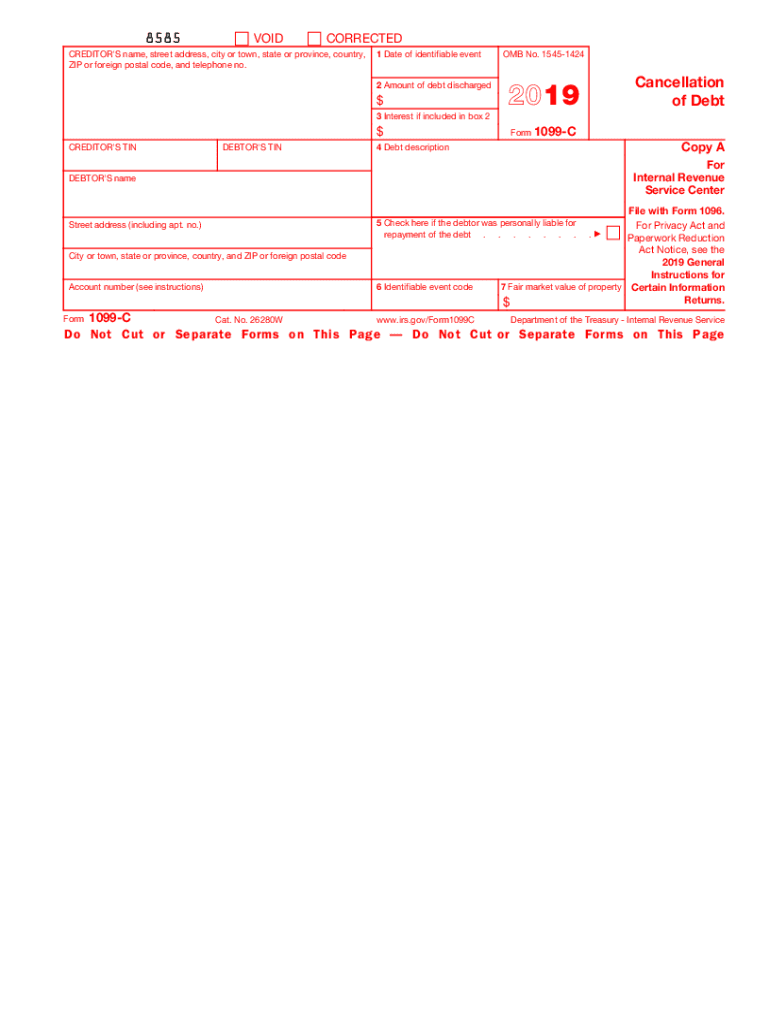

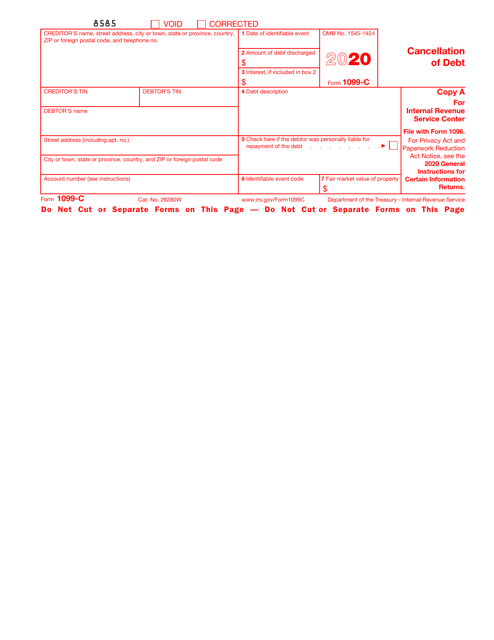

The IRS requires that all income and deductible expenses are reported by businesses and individuals or penalties could applyCancellation of Debt (Info Copy Only) Form 1099C 8585 VOID CORRECTED CREDITOR'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no 1 Date of identifiable event 2 Amount of debt discharged $ 3 Interest, if included in box 2 $ CREDITOR'S TIN DEBTOR'S TIN OMB No Form 1099C Copy A 4 DebtWhy would I receive Form 1099A?

Irs 1099 C Form Pdffiller

E File Form 1099 With Your 21 Online Tax Return

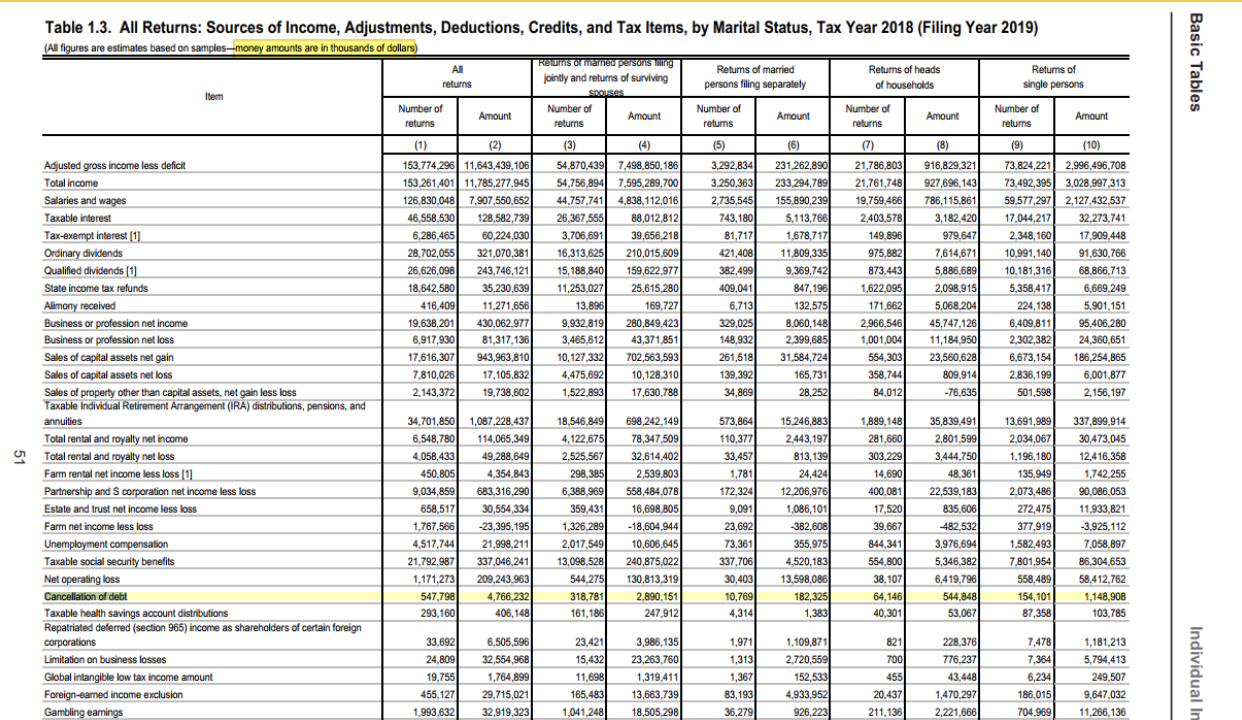

IRS Form 1099C reports a canceled debt to you and to the IRS when a lender forgives an outstanding loan you owe and no longer holds you responsible for paying it The IRS takes the position that canceled debt is taxable income to you and must be reported on your tax return Lenders must issue Form 1099C when they forgive debts of more than $600It's not terribly common, but it's far from rare Using the latest statistics on the subject available from the 18 update of the IRS Office of Research's Publication 6961, almost four million 1099C forms were sent out—and presumably, were filed on or beforeForm 1099C is used to report the cancellation of a debt Why do I file 1099C?

1099 C 19 Public Documents 1099 Pro Wiki

3

Fill out 19 Form 1099C Cancellation Of Debt in just a couple of moments by using the instructions listed below Pick the document template you require in the collection of legal form samples Click the Get form key to open the document and move to editing Submit all of the requested boxes (these are yellowish)On the screen titled Cancellation of Debt Form 1099C Information, enter the information from Form 1099A as follows Enter Box 1 (1099A) in Box 1 (1099C) Generally, enter Box 2 (1099A) in Box 2 (1099C) However, if the amount of debt canceled is different from the amount reported in Box 2 of your 1099A, enter the amount of debt actuallyForm 1099MISC Miscellaneous Income (Info Copy Only) Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income Inst 1099MISC Instructions for Form 1099MISC, Miscellaneous Income 19

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

1099 Form 19 Due Date

IRS Form 1099C is used by creditors (including domestic bank, a trust company, a credit union) to report the cancellation of $600 or more in debt owed to the debtors such as an individual, corporation, partnership, trust, estate, association or company A 1099C Form must be filed regardless of whether the debtor chooses to report the debt asAfter fill out the document, you are free to print, download, and send the form If you have any more worries, please talk to the support team to receive answers By working with CocoSign, you can fill in Instructions Form 1099 C 18 19 and place your digital signature instantly How Common Is It to Receive a 1099C?

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

Buy 1099 Misc Tax Forms 19 Tangible Values 4 Part Kit With Envelopes Software Download Included 25 Pack Online In Indonesia Ba95i

What Is Form Instruction 1099A & 1099C?

Instructions Form 1099 C Fill Out And Sign Printable Pdf Template Signnow

How A Form 1099 C Affects Taxes Innovative Tax Relief

1099 Form 19 Office Depot

Tax Forms Federal Copy A 19 Laser 1099c Tax Forms 150 Pk Office Products Ty Store Net

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

1040 Form 19 Pdf Schedule C

2

How To File 1099 Misc For Independent Contractor

2

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

1099 C Form Copy A Federal Discount Tax Forms

I Received A Form 1099 Misc What Should I Do Godaddy Blog

Index Of Forms

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

Deadlines For Tax Year 19 Public Documents 1099 Pro Wiki

2

When A Lender Must File And Send A Form 1099 C To Report Debt Forgiveness Frost Brown Todd Full Service Law Firm

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

Given The Following Information Complete The 19 Chegg Com

Instant Form 1099 Generator Create 1099 Easily Form Pros

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 19 Templateroller

Important Q1 19 Tax Deadlines Pugh Cpas

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1

1099 Misc State Copy C Forms Fulfillment

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Solved I Need To Know About The Insolvency Exception For 1099 C Do I Qualify How Do I Claim Insolvency

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Tax 1099 Form Filing Deadlines For The Year 19

Form 1099 Nec For Nonemployee Compensation H R Block

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

1099 C Form Fill Out And Sign Printable Pdf Template Signnow

Office Products Office Supplies Kanagaandassociates Co Ke 1099 Misc Copy C Bulk Discount Tax Form 1 000 Recipients

1099 Form 19 File 1099 Misc 19 Efile Irs Form 1099 Misc 19

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Download Instructions For Irs Form 1099 A 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Pdf Templateroller

What Are Irs 1099 Forms

1099 Tax Misc Form 1099 Misc Form 19 File 1099 Misc Form

1099 A Form And 1099 C Tax Preparer Course Youtube

1099c Form Calculator Printable Pdf Sample

Irs Form 9 Is Your Friend If You Got A 1099 C

1099 C Fill Out And Sign Printable Pdf Template Signnow

What Are The Required Documents For A Ppp Loan Faq Womply

1099 C Defined Handling Past Due Debt Priortax

1099 C Cancellation Of Debt H R Block

1040 Form 19 Pdf Schedule C

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

Irs Form 1099 Reporting For Small Business Owners In

What Does A 1099 C Cancellation Of Debt Mean

Fill Free Fillable Irs Pdf Forms

3

Horizon Software Firetax

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

1099 Misc Form Fillable Printable Download Free Instructions

About Form 1099 C Cancellation Of Debt Plianced Inc

1099 Misc Form Fillable Printable Download Free Instructions

:max_bytes(150000):strip_icc()/ScheduleC-22b719c014fd419b89315bb420243dcf.jpg)

Irs Schedule C What Is It

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

Irs Form 1099 C And Canceled Debt Credit Karma Tax

Buy Office Depot Brand 1099 Misc Laser Tax Forms 19 Tax Year 2 Up 4 Part 8 1 2 X 11 Pack Of 50 Form Sets Online In Germany B07zbjnvlz

Irs 1099 C Form Pdffiller

What Is An Irs Schedule C Form And What You Need To Know About It

The 10 Tax Forms People Forget To Fill Out Mediafeed

Verticalive Forms

How Can I Pay The Taxes For The Income Shown On My 1099 C

Payday Lender Is Threatening Me With A 1099 C Irs Form Julia

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

Step By Step Instructions To Fill Out Schedule C For

1099 C Defined Handling Past Due Debt Priortax

1099 Form Irs 19

Instructions C 18 Fill Out And Sign Printable Pdf Template Signnow

Fillable Form 1040 Schedule C 19 In 21 Irs Tax Forms Credit Card Statement Tax Forms

Irs 1099 Misc Form Pdffiller

What To Do If You Get This Most Dreaded Tax Form Marketwatch

2

1099 C What You Need To Know About This Irs Form The Motley Fool

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

0 件のコメント:

コメントを投稿